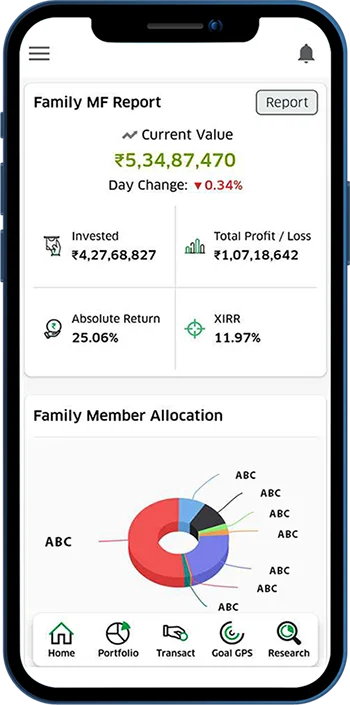

You can download the complete portfolio report including mutual funds & other assets. Get the historical performance of your portfolio easily & track the portfolio at your fingertips.

Who We Are

Your Trusted Partner in Financial Planning

At SM Money Care, we believe in creating personalized financial strategies that aling with your goals and values

With over 15 years of industry experience, SM Money Care has helped more than 600 clients achieve their financial goals through personalized planning and strategic investment choices. We believe that financial planning should be accessible and understandable for everyone.

Our approach combines technical expertise with clear communication, ensuring you always feel informed and confident about your financial decisions. Our mission is to empower individuals and businesses with the knowledge and tools to achieve financial security and growth. Lets work together to make your goals a wonderful reality.

How We Work

Our Three-Step Approach

We follow a simple yet effective process to help you achieve your financial goals with clarity and confidence

Ready to begin your journey towards financial stability and growth?

Start Your PlanWhat We Offer

Comprehensive Financial Services

As your dedicated insurance advisor, we provide a wide range of financial services tailored to meet your unique needs and goals

General Insurance

General insurance provides coverage for risks other than life, including property, motor, travel, and liability insurance. It ensures financial protection against unforeseen events, giving you peace of mind.

Health Insurance

Health insurance ensures financial security during medical emergencies by covering hospitalization costs, treatments, and other healthcare expenses. It helps you access quality medical care without worrying about financial strain.

Life Insurance

Life insurance provides financial protection to your family in the event of your untimely demise. It ensures that your loved ones can maintain their lifestyle and meet essential expenses in your absence.

Personal Accident

Personal accident insurance provides financial coverage in case of accidental injuries, disabilities, or death. It ensures that you and your family are protected from unexpected financial burdens arising from accidents.

Mutual Funds

Investing in mutual funds is a smart option to grow your wealth. Mutual funds pool money from various investors to buy a diversified portfolio of stocks, bonds, and other securities. This diversified approach reduces risk and allows you to benefit from professional fund management.

Corporate Bonds

Corporate bonds are debt instruments issued by companies to raise capital for business operations, expansion, or other financial needs. Investors who purchase these bonds are essentially lending money to the company in exchange for periodic interest payments and the repayment of the principal amount at the bond's maturity date.

Retirement Planning

Retirement planning is the process of setting financial goals and creating a strategy to ensure you have sufficient funds to maintain your lifestyle and meet expenses during your retirement years. It involves saving, investing, and managing finances to ensure financial security when you stop earning actively.

Portfolio Management Services

Portfolio Management Services (PMS) offer personalized investment strategies designed to meet your financial goals. With expert guidance and tailored portfolios, PMS helps investors navigate market fluctuations and achieve sustainable growth.

Pre-IPO Shares

Pre-IPO shares are shares of a company that are offered for investment before the company goes public through an Initial Public Offering (IPO). These shares are sold to private investors, institutional investors, and high-net-worth individuals during the early stages of growth to raise capital for expansion and operations.

Not sure which service fits your needs? Contact us for a personalized consultation

Plan With UsFinancial Tools

Power Of SIP Calculator

Discover how small, regular investments can grow over time the power of compound interest

Want to learn more about how systematic investments can help you achieve your financial goals?

Get Expert AdvicePower of SIP

Get Started with SM Money Care

-

Portfolio Analysis

-

Invest Online

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

-

Goal Tracker

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

-

Research

Invest in well researched cherry-picked perfectly balanced portfolio.

Stay Informed

Market Updates

Keep up with the latest financial news, market trends, and insights to make informed decisions

Client Stories

What Our Clients Say

Hear from individuals and businesses who have transformed their financial journey with our guidance

Amit Badaya

Last year, I met with a road accident that resulted in high medical bills. Thankfully, I had an accidental policy recommended by SM Money Care. Sanjay Modi's team was quick to step in, guiding me through the claim process and ensuring I didn't face any additional stress. The claim was approved faster than I expected, and I received the full settlement without any hurdles. Their proactive and empathetic approach is something I'll always appreciate.

Harsh khandelwal

As a business owner, I needed someone trustworthy to handle my insurance needs. SM Money Care provided me with a comprehensive business insurance plan that covered all my risks. Their attention to detail and thorough explanations gave me confidence that my company is well-protected. Sanjay and his team are approachable and always ready to help. Working with them has been one of my best decisions.

Pradeep Agarwal

I had investments scattered across multiple funds and policies, which was difficult to track and manage. That's when I approached SM Money Care. Sanjay Modi and his team reviewed my entire portfolio and created a clear, goal-oriented plan. They explained complex terms in simple language and consolidated my investments to maximize returns. Today, I feel in control of my finances and confident about my financial future. Their personalized service and dedication have made all the difference. I trust SM Money Care completely for their expertise and client-centric approach.

Ashok Koolwal

As parents, our biggest concern was securing our daughter's future, especially her education. SM Money Care introduced us to the concept of Systematic Investment Plans (SIP) and helped us choose the right one based on our goals and budget. Over the years, the disciplined investment has grown significantly, giving us peace of mind that her education is financially secure. Sanjay Modi and his team have always been approachable and proactive, ensuring we stay on track with our plans. I highly recommend SM Money Care for anyone looking to create a stable financial future for their loved ones.

Manish Jindal

SM Money Care has been instrumental in guiding me towards sound investment decisions. Their expert advice and personalized approach have helped me achieve my financial goals with confidence. Highly recommended!

Sharad Jhalan

The team at SM Money Care is professional, knowledgeable, and always ready to assist. Their financial insights and strategic planning have significantly improved my portfolio performance. A trustworthy partner in wealth management!

Want to learn more about how systematic investments can help you achieve your financial goals?

Get Expert AdviceAmit Badaya

website developer

Last year, I met with a road accident that resulted in high medical bills. Thankfully, I had an accidental policy recommended by SM Money Care. Sanjay Modi's team was quick to step in, guiding me through the claim process and ensuring I didn't face any additional stress. The claim was approved faster than I expected, and I received the full settlement without any hurdles. Their proactive and empathetic approach is something I'll always appreciate.

Harsh khandelwal

project manager

As a business owner, I needed someone trustworthy to handle my insurance needs. SM Money Care provided me with a comprehensive business insurance plan that covered all my risks. Their attention to detail and thorough explanations gave me confidence that my company is well-protected. Sanjay and his team are approachable and always ready to help. Working with them has been one of my best decisions.

Pradeep Agarwal

sales manager

I had investments scattered across multiple funds and policies, which was difficult to track and manage. That's when I approached SM Money Care. Sanjay Modi and his team reviewed my entire portfolio and created a clear, goal-oriented plan. They explained complex terms in simple language and consolidated my investments to maximize returns. Today, I feel in control of my finances and confident about my financial future. Their personalized service and dedication have made all the difference. I trust SM Money Care completely for their expertise and client-centric approach.

Ashok Koolwal

sales manager

As parents, our biggest concern was securing our daughter's future, especially her education. SM Money Care introduced us to the concept of Systematic Investment Plans (SIP) and helped us choose the right one based on our goals and budget. Over the years, the disciplined investment has grown significantly, giving us peace of mind that her education is financially secure. Sanjay Modi and his team have always been approachable and proactive, ensuring we stay on track with our plans. I highly recommend SM Money Care for anyone looking to create a stable financial future for their loved ones.

Manish Jindal

SM Money Care has been instrumental in guiding me towards sound investment decisions. Their expert advice and personalized approach have helped me achieve my financial goals with confidence. Highly recommended!

Sharad Jhalan

The team at SM Money Care is professional, knowledgeable, and always ready to assist. Their financial insights and strategic planning have significantly improved my portfolio performance. A trustworthy partner in wealth management!